Has there been a death in your family with a connection to Slovakia? Do you urgently need an overview of the inheritance procedure in Slovakia?

Here you will find the most important information on inheritance proceedings in the Slovak Republic and other interesting facts about inheritance.

To avoid any confusion and to give you an initial overview, the following FAQ briefly summarizes the most important information on Slovak inheritance law - all explained in a clear and practical manner.

As a general rule, property succession is by will or - in the absence of a will - by intestate succession.

It should be emphasised in particular that Slovak inheritance law does not recognize joint wills between spouses. A joint will drawn up by spouses would be invalid. However, each of the spouses can draw up their own will.

Wills can be handwritten, drawn up by a notary, or the testator can also make a will in another written form (e.g. electronically). However, they must sign the will themselves and expressly declare that it is their will in the presence of two witnesses. The witnesses must also sign the will. To avoid the risk of loss, the will can be deposited in the notarized central register of wills.

Legal succession in Slovakia is based on four groups of heirs. In the first group, the children of the deceased and the spouse inherit in equal shares.

In the second group succession, whereby the deceased has no children (or the children do not inherit for any reason), all heirs inherit in equal shares, but the spouse is entitled to at least half of the inheritance. The spouse inherits together with the deceased's parents and with the persons who lived with the deceased in the same household for at least one year before the deceased's death and took care of the household (e.g. civil partner), or who were maintained by the deceased (e.g. the civil partner's child).

However, if not only do no children inherit, but neither do the deceased's spouse or parents, the third group of heirs comes into play: namely the deceased's siblings and the persons who lived with them in the same household for at least one year before their death and looked after the household, or were maintained by the deceased. They inherit in equal shares. If one of the deceased's siblings does not inherit, their share of the inheritance is divided equally between their children (i.e. the deceased's nephews and nieces). However, if the children of the deceased's siblings do not inherit either, their children, i.e. the great-nephews and great-nieces of the deceased, are no longer included in the line of succession.

If none of these persons inherit either, the fourth and final group of heirs take over - the deceased's grandparents or, if there are no grandparents, the deceased's uncles and aunts. However, the children of the aunts and uncles (i.e. the cousins of the deceased) have no claim to the inheritance.

If there are no legal heirs, the estate goes to the state. A right to a compulsory portion exists exclusively in favor of the descendants: minors are entitled to their full legal share of the inheritance, and descendants who have reached the age of adulthood are entitled to half of their legal share. Spouses are not entitled to a compulsory portion and are only protected by statutory succession.

In Slovakia, probate proceedings are automatically initiated by the competent court, which appoints a notary to handle the process. The notary identifies the heirs, secures the estate, checks wills and clarifies claims. The procedure ends with a court order that bindingly determines the inheritance and its distribution.

Slovak inheritance law requires careful legal organization in many cases. Whether it is a matter of wills, compulsory portions, international estates, or handling by notaries - sound advice is crucial in order to avoid disputes or delays later on..

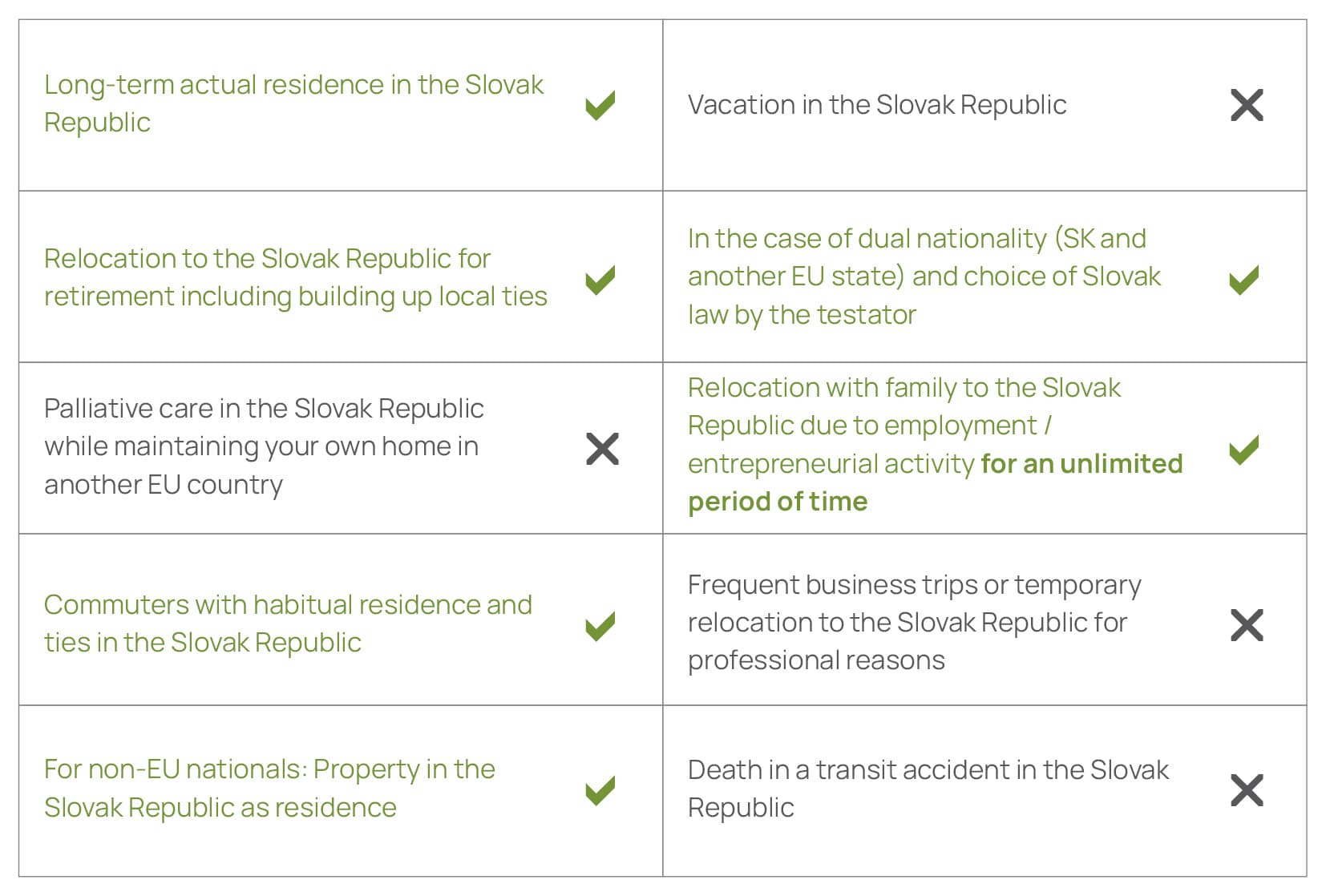

The following points are decisive for this:

Duration and regularity of the deceased's stay in Slovakia

Circumstances and reasons for the stay in Slovakia

Family and social ties of the deceased to Slovakia (center of life)

Most important examples

In principle, the following applies: If the circumstances of the testator's life cannot be clearly assigned, an overall assessment must be made, taking into account where the testator

had social and economic ties

owned assets such as real estate

had bank accounts

visited doctors or schools, etc.

A clear decision can therefore be quite difficult in individual cases.

Probate proceedings are conducted before the competent court. However, unlike in Germany, for example, the court in Slovakia appoints a notary to handle the proceedings. As an heir, you are a party to these proceedings and can assert your rights in the course of them.

Initiates the probate proceedings

Authorizes the responsible notary to carry out the transaction

Decides on the probate proceedings through the notary

Decides alongside the notary on objections of the parties involved

Participates in the proceedings

Cooperates with the notary and assists with the determination of the estate

Submits the necessary documents to the notary (e.g. death certificate)

Administers the estate (if instructed by the notary)

Challenges the inheritance (if necessary)

Applies to the notary for resolutions and the European certificate of inheritance

Disposes of the estate jointly with the other heirs

Makes agreements with other heirs or other authorised parties

The notary asks

Who could be a potential heir?

Did the testator leave a will?

What assets are there in the estate?

What bank accounts did the deceased have?

In which countries did the deceased have assets?

The notary states

Heirs or other authorized parties

Contents of the will

Scope and value of the estate

The notary prepares

The European certificate of inheritance (on application)

All documents and, on this basis, the corresponding preliminary investigations

The minutes of the probate hearing

The decision on the inheritance

Slovak inheritance law contains specific peculiarities. Succession can be determined by will or regulated by law. The testator can only regulate their succession through a will. If there is no last will and testament, or it is ineffective, statutory succession applies.

Will

Wills can be handwritten, notarized, or drawn up in another written form (or electronically). However, the testator must sign a will drawn up in another written form themselves and expressly declare in the presence of two witnesses that it is their will. The witnesses must also sign the will. To avoid the risk of loss, the will can be deposited in the Slovak central notarial register for wills.

Legal succession

Legal succession in Slovakia is based on four groups of heirs. First, in the first group, the children of the deceased and the spouse inherit in equal shares. In the second group succession, whereby the deceased has no children (or the children do not inherit for any reason), all heirs inherit in equal shares, but the spouse is entitled to at least half of the inheritance. The spouse inherits together with the deceased's parents and with the persons who lived with the deceased in the same household for at least one year before the deceased's death, and took care of the household (e.g. civil partner) or who were maintained by the deceased (e.g. the civil partner's child).

However, if not only do no children inherit, but neither do the deceased's spouse or parents, the third group of heirs comes into play: namely the deceased's siblings and the persons who lived with them in the same household for at least one year before their death and looked after the household, or were maintained by the deceased. They inherit in equal shares. If one of the deceased's siblings does not inherit, their share of the inheritance is divided equally between their children (i.e. the deceased's nephews and nieces). However, if the children of the deceased's siblings do not inherit either, their children, i.e. the great-nephews and great-nieces of the deceased, will no longer be included in the line of succession. If none of these persons inherit either, the fourth and final group of heirs take over - the deceased's grandparents or, if there are no grandparents, the deceased's uncles and aunts. If there are no legal heirs, the estate passes to the state.

Right to a compulsory portion

Only descendants are entitled to a compulsory portion: minors are entitled to their full legal share of the inheritance, and descendants who have reached the age of adulthood are entitled to half of their legal share. Spouses are not entitled to a compulsory portion and are only taken into account in the statutory succession. The compulsory portion can be granted as a monetary claim. It can be withdrawn under certain circumstances (e.g. if the descendant permanently shows no sincere interest in the testator).

Probate proceedings

After the death of the deceased, Slovak probate proceedings are automatically initiated by the competent district court, which appoints a notary as the court representative. The notary is responsible for determining the heirs, securing the estate, and establishing the assets. The notary examines wills and informs the heirs of their rights, particularly in waiving the inheritance. The notary determines the estate assets, obtains information from the authorities, and ensures that all relevant assets and debts are recorded.

The estate is distributed on the basis of statutory inheritance quotas or testamentary dispositions. Claims to a compulsory portion are taken into account. If the heirs agree on the distribution, the proceedings can be concluded quickly; in the event of disputes, the court decides. The proceedings end with a court order ("uznesenie o dedičstve"), which confirms the inheritance and determines the distribution. An appeal against this decision can be lodged with the local court.

Slovak notaries play a central role in the probate process, taking on both administrative and legal tasks, but working under difficult conditions, which can lead to delays - especially in international inheritance cases.

Acceptance and settlement of inheritance

The inheritance can either be accepted or waived. Acceptance is automatic upon the death of the deceased; express consent is not required. The heir becomes the legal successor and is liable for the deceased's debts. The heirs are liable for the debts of the deceased - even with their own assets - but only up to the value of the inheritance acquired. The waiver of inheritance means the complete waiver of rights and obligations, as a result of which all liability is cancelled.

Executor

The testator can propose an estate administrator or administrator of individual estate components in the will. If necessary, the notary will appoint an estate administrator whose task it is to carry out all measures to preserve the value of the estate during the ongoing proceedings. An estate administrator can also be appointed at the request of the heirs, particularly in cross-border cases.

Cross-border inheritance cases

According to the EU Succession Regulation (EuErbVO), decisions of European courts are generally recognized in the Slovak Republic, including in the case of real estate. A European Certificate of Succession (ECC) is issued by notaries during the succession proceedings or by courts afterwards. The ENZ enables cross-border recognition of succession. Nevertheless, detailed information on the inherited assets is required, particularly in the case of real estate. In complex cases, it is advisable to appoint an estate administrator to ensure efficient handling of the succession proceedings.

Revocable unilateral disposition of the testator

Possible effective forms:

Private, handwritten, and signed document

Deed drawn up by a notary

Document drawn up electronically by the testator, signed themself and declared in front of two witnesses (signed on the will) that this is their last will and testament

Special case: If the testator is incapable of writing the will themselves; the presence of three witnesses is required. The testator must be informed of the content and declare that it corresponds to their last wishes.

All of the testator's property can be disposed of in the will.

The will may also contain other provisions, including

Disinheritance

Non-binding instructions for the heirs (e.g. type of burial)

Determination of substitute heirs

A private will can also be deposited with a notary; in this case, like notarized wills, it is registered and kept in the Slovak Central Register of Notarial Wills.

If there are several competing wills, the most recent will takes precedence!

Used when there is no will.

Legal succession in Slovakia distinguishes between four groups of heirs.

In principle, the acceptance of an inheritance by an heir of the previous group excludes the inheritance claim of the subsequent group; the starting point is the 1st group.

The groups are as follows:

Children of the deceased and spouse - inherit in equal shares. If one of the children does not inherit, their children acquire their share. The same applies to more distant descendants of the same ancestor. If no children inherit, the spouse does not inherit alone, but in the second group of heirs.

Spouse, parents of the deceased, and persons living together (at least 1 year in the same household, who took care of the household or were maintained by the deceased). Heirs inherit in equal shares; however, the spouse receives at least half of the estate. If neither the spouse nor the parents of the deceased inherit, the persons living together do not inherit alone, but inherit in the third inheritance group.

Siblings of the testator and persons living together (as in the 2nd group). If one of the siblings does not inherit, their share of the inheritance passes to their descendants.

The deceased's grandparents: if none of them inherit, then their children - the uncles and aunts (or nieces and nephews) of the deceased will inherit.

Children of the deceased's siblings and children of the deceased's grandparents inherit in equal shares. If one of the grandparents' children does not inherit, their children inherit.

Even if you were not named as an heir in the will, you may still be entitled to a portion of the deceased's assets. This applies in particular to those entitled to a compulsory portion, spouses, and creditors of the deceased.

Persons entitled to a compulsory portion

Children of the deceased and their descendants

Legal adults entitled to a compulsory portion are entitled to half of their statutory inheritance share

Minors entitled to a compulsory portion are entitled to their entire statutory inheritance share

Spouse (community of property)

If there was a community of property between the deceased and the surviving spouse, this is first dissolved

The surviving spouse's share is allocated to them

Only then is the estate determined and divided among the heirs accordingly

Creditor

In Slovak inheritance proceedings, the claims of the deceased's creditors are also taken into account

The debts of the deceased are included in the estate

The debts are transferred to the heirs upon acceptance of the inheritance

Ineligibility for inheritance in Slovakia

Ineligibility to inherit occurs by operation of law without any legal action on the part of the testator being required. It is an objective legal situation in which the potential heir is excluded from the right of inheritance on legally defined grounds. However, the potential heir inherits if the testator has forgiven him or her.

Grounds for ineligibility under Slovak law

Committing an intentional criminal offence against the deceased, their spouse, children or parents

Reprehensible act against the last will of the testator.

Disinheritance in Slovak inheritance law

Disinheritance, on the other hand, is an active legal act by the testator through which he or she explicitly excludes a person entitled to a compulsory portion from the right to a compulsory portion.

Characteristic features of disinheritance

Formal requirements - The declaration of disinheritance requires the same form as a will, e.g. notarised or handwritten and signed.

Active decision of the testator - also possible directly in the will, whereby the reason must always be expressly stated.

Possibility of amendment or revocation - The testator can amend or revoke a disinheritance that has already been pronounced at any time, provided this is done in the form applicable to wills.

Reasons for a lawful disinheritance of a person entitled to a compulsory portion

The testator can disinherit a person entitled to a compulsory portion if this person:

has not provided the deceased with the necessary assistance in the event of illness, old age or other serious circumstances,

permanently shows no sincere interest towards the testator, as is expected of a descendant,

has been sentenced to at least one year's imprisonment for an intentional criminal offence,

leads a permanently disorganised life.

Are you unsure whether you should accept the inheritance? Are you worried about the estate becoming overindebted? Are you afraid of being liable for debts with your own assets? Then you should know this:

First and foremost, it is important to know that the inheritance is automatically accepted upon the death of the deceased. If you do not wish to accept the inheritance, you must expressly waive the inheritance in the probate proceedings within a period of one month from the date on which the court or notary informed you of the right to waive the inheritance and of the consequences of waiving it.

In the course of the probate proceedings, an estate balance sheet is drawn up by the competent notary.

As an heir, you can thus gain an overview of whether the estate is overindebted and whether you should disclaim the inheritance.

To avoid hidden debts, it is advisable to ask the notary to carry out a so-called "convocation" (i.e. to ask the deceased's creditors to disclose the debts that the deceased owed them). This will ensure that you are only liable up to the value of the inheritance you have acquired and avoid potential complications. It also allows you to better assess whether you should disclaim the inheritance.

If you as the heir realize that the inheritance is overindebted, you are generally entitled to disclaim the inheritance!

Caution: Acceptance or renunciation of the inheritance is irrevocable!

Unwanted dispositions of the estate during the probate proceedings are prevented by a rapid inventory assessment and, if necessary, by the notary ordering urgent measures.

Inventory of the estate

The extent of the estate (assets and liabilities) is determined by the notary.

Determined retroactively to the date of death of the deceased.

Useful for determining dispositions of the estate after the death of the testator.

Possible urgent measures

Safekeeping or sealing of items belonging to the estate.

Order prohibiting the disposal of the funds in the deceased's bank accounts.

Sale of items that cannot be stored without risk of damage or disproportionate costs.

Appointment of an administrator of the estate or part of the estate.

Remuneration of the notary

The notary's remuneration for handling the probate proceedings is based on a percentage that depends on the value of the estate.

Appraisal fees

In order to determine the value of the estate (in particular real estate, motor vehicles), it may be necessary to determine the value of the estate on the date of the deceased's death by means of an expert opinion.

Remuneration of the estate administrator

The amount of the estate administrator's remuneration depends primarily on the scope of his services.

Legal fees

The amount of the legal fees depends on the scope of the legal advice.

Tax burden

The tax burden depends on the place where the heirs are resident for tax purposes. There is no inheritance tax in Slovakia.

Who can support me?

Inheritance proceedings abroad can be a particular burden - whether due to language barriers or geographical distance. We understand your situation and are at your side with experience, empathy and legal expertise.

Giese & Partner has been one of the leading international law firms in Slovakia for more than 20 years. We have extensive experience in cross-border inheritance proceedings. Our teams of Slovak lawyers will explain the legal situation in the country to you in an understandable way, and will enforce your rights with the notary and the court in the best possible way - from local district courts to European courts.

We provide you with comprehensive and personalized support in the settlement and administration of international inheritances and estates within and outside the EU.

Our experts on inheritance law