Has there been a death in your family with a connection to the Czech Republic? Do you urgently need an overview of the inheritance procedure in the Czech Republic?

Here, you will find the most important information on inheritance proceedings in the Czech Republic and other interesting facts about inheritance.

To avoid any confusion and to give you an initial overview, the following FAQ briefly summarizes the most important information and here you can find the most important decisions by Czech courts - all explained in a clear and practical way.

Succession is by will, inheritance contract, or according to the rules of statutory succession (if there is no valid last will).

Czech inheritance law does not recognize a joint will between spouses. Instead, they can regulate their succession by means of a notarized contract of inheritance. This takes precedence over a will.

Wills can be handwritten or notarized. In special cases, electronic wills are also permitted. To avoid the risk of loss, both notarized and handwritten wills can be deposited in the central register of wills.

Bequests offer the possibility of transferring individual assets to third parties without them becoming heirs. As a rule, legatees are not liable for the debts of the deceased; their claims are directed against the heirs.

The statutory succession in Czech inheritance law follows a six-tier system. In the first order, children and spouses inherit in equal shares; in the subsequent orders, parents, siblings, grandparents or even unrelated persons are added if they lived in the same household as the deceased or were supported by the deceased. If there are no legal heirs, the estate falls to the state. The right to a compulsory portion exists primarily in favor of descendants: Minors are entitled to three quarters, adults to one quarter of their statutory inheritance share. Spouses are not entitled to a compulsory portion and are only protected by statutory succession.

Probate proceedings in the Czech Republic are automatically initiated by the competent court, which appoints a notary to handle them. The notary identifies the heirs, secures the estate, checks wills, and clarifies claims. The procedure ends with a court order that bindingly determines the inheritance and its distribution.

Czech inheritance law requires careful legal structuring in many cases. Whether it is a matter of wills, compulsory portions, international estates or handling by notaries - sound advice is crucial to avoid disputes or delays later on.

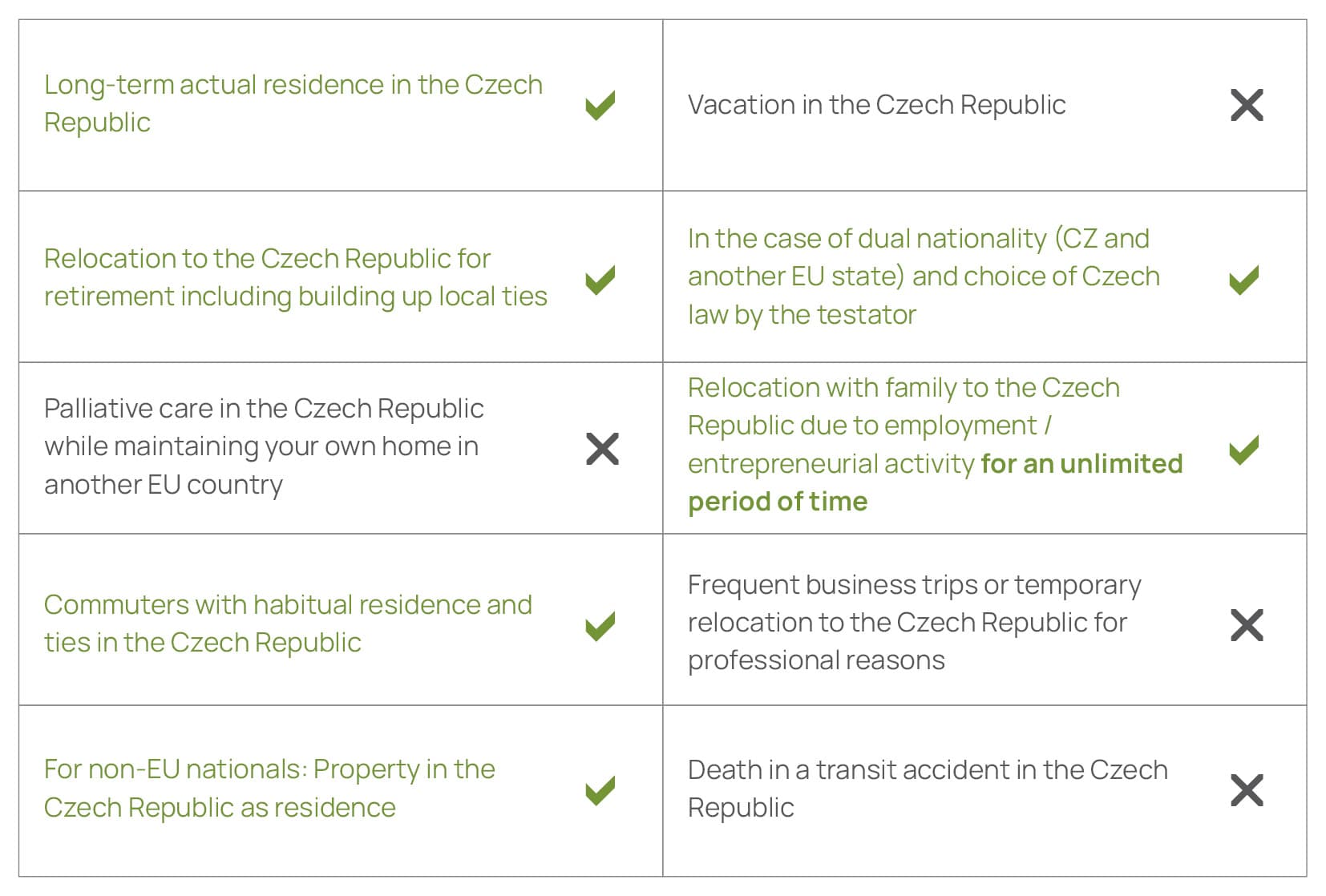

The following points are decisive for this:

Duration and regularity of the deceased's stay in the Czech Republic

Circumstances and reasons for staying in the Czech Republic

Family and social ties of the deceased to the Czech Republic (center of life)

Most important examples

In principle, the following applies: If the circumstances of the testator's life cannot be clearly assigned, an overall assessment must be made, taking into account where the testator

Had visited a doctor or school

Had their property,

Held bank accounts,

Had social and economic ties, etc.

A clear decision can therefore be quite difficult in individual cases.

Probate proceedings are conducted before the competent court. The court appoints a notary to handle the proceedings. As an heir, you are a party to these proceedings and can assert your rights throughout the course of them.

Initiates the probate proceedings

Instructs the relevant notary with the execution

Decides on the probate proceedings through the notary

Decides on objections of the parties involved

Participates in the proceedings

Cooperates with the notary and assists in determining the estate

Submits the necessary documents to the notary (e.g. death certificate)

Manages the estate

Accepts the inheritance / Rejects the inheritance

Applies to the notary for resolutions and the certificate of inheritance

Disposes of the estate

Makes agreements with other heirs or other beneficiaries

The notary asks

Who could be a potential heir?

Did the testator leave a will or similar?

What assets are there in the estate?

What bank accounts did the deceased have?

In which countries did the deceased have assets?

The notary states

The heirs or other beneficiaries

The content of the will / inheritance contract

Which disposition on death applies (priority / most recent disposition)

The size and value of the estate.

The notary prepares

The certificate of inheritance (on application)

All documents and, on this basis, the corresponding preliminary investigations

The minutes of the probate hearing

If necessary, the decision of the heirs on the distribution of the estate.

Succession can be determined by will or regulated by law. The testator can regulate his succession by will, contract of inheritance, or legacy. If a testamentary disposition is missing or ineffective, statutory succession applies.

Will

A will can be handwritten or notarized. In special cases, electronic wills are possible, provided that two independent witnesses sign. Blind or severely visually impaired testators require three witnesses. Notarized wills are recorded in the central register of wills. Self-written wills can also be deposited there to minimize the risk of loss.

Contract of inheritance

An inheritance contract makes it possible to appoint a contracting party or third party as heir or legatee. This is particularly relevant for spouses, as Czech law does not provide for a joint will. An inheritance contract requires notarization and takes precedence over a will. However, it can be revoked by a court application after divorce. The testator's power of disposal is limited to 3/4 of the assets.

Legacies

Bequests allow the testator to transfer certain assets to beneficiaries. Legatees or said beneficiaries are not liable for the testator's debts and only have a claim against the heirs.

Legal succession

Legal succession (§§ 1633 ff. BGB-CZ) is based on the parental system with six orders of inheritance. In the first order, descendants and spouses inherit in equal shares. In the second order, the spouse inherits at least half, while the deceased's parents and household members receive the remainder. From the third order onwards, siblings, grandparents, great-grandparents, uncles, aunts, great-nephews, and great-nieces inherit. A special feature of Czech law is that persons not related to the deceased can inherit if they lived with him or her in the same household for at least one year or were dependent on them. If there are no heirs of any order, the inheritance goes to the state.

Right to a compulsory portion

The Czech right to a compulsory portion ensures that certain relatives of the deceased - the descendants in particular - receive a statutory minimum share of the estate, irrespective of testamentary dispositions. Minor descendants receive at least ¾ of their statutory inheritance share, adult descendants ¼. Spouses are not entitled to a compulsory portion, but are included in the statutory succession. The compulsory portion is usually granted as a monetary claim. It can be withdrawn under certain circumstances, for example in the event of gross breaches of duty towards the testator or the family. If a person entitled to a compulsory portion ceases to exist (e.g. through renunciation or ineligibility to inherit), this does not increase the entitlement of other persons entitled to a compulsory portion.

Probate proceedings

Czech probate proceedings are automatically initiated after the death of the deceased by the competent district court, which appoints a notary as a court commissioner. This notary is responsible for determining the heirs, securing the estate and establishing the assets. He examines inheritance contracts and wills and informs the heirs of their rights, particularly in accepting or waiving the inheritance. The notary determines the estate assets, obtains information from the authorities, and ensures that all relevant assets and debts are recorded.

The estate is distributed on the basis of statutory inheritance quotas or testamentary dispositions. Claims to a compulsory portion are taken into account. If the heirs agree on the distribution, the proceedings can be concluded quickly; in the event of disputes, the court decides. The proceedings end with a court order (dědické usnesení), which confirms the inheritance and determines the distribution. It can be appealed to the district court.

Czech notaries play a central role in probate proceedings, taking on both administrative and legal tasks, but working under difficult conditions, which can lead to delays - especially in international inheritance cases.

Acceptance of inheritance and bequest

Heirs can either accept or reject an inheritance. Acceptance is automatic upon the death of the deceased; express consent is not required. The heir becomes the legal successor and is liable for the deceased's debts. Without any special reservation, the heirs are jointly and severally liable for their own assets. Liability can be limited to the value of the estate by making a timely declaration in an estate inventory. This applies to each heir individually. The waiver of inheritance means the complete waiver of rights and obligations, which eliminates all liability. This right can be excluded by an inheritance contract.

Executor of the will and administrator of the estate

The testator can appoint an executor who is responsible for implementing the last will and testament. This includes the administration of the estate, the settlement of debts, and the distribution of the inheritance. Alternatively, or additionally, an estate administrator can be appointed to administer the estate until the conclusion of the court proceedings. He or she can also be appointed by the court, particularly if the succession is unclear or the value of the estate is high. An estate administrator can also be appointed at the request of the heirs, particularly in cross-border cases.

Cross-border inheritance cases

According to the EU Succession Regulation (EuErbVO), decisions of European courts are generally recognized in the Czech Republic, even in the case of real estate. A European Certificate of Succession (ECC) is issued by notaries during the succession proceedings or by courts afterwards. The ENZ enables cross-border recognition of succession. Nevertheless, detailed information on the inherited assets is required. Since 2020, it has been possible to attach a supplementary declaration for more precise identification of real estate, but this must be notarized and translated. This represents an additional hurdle for foreign heirs. In complex cases, it is advisable to appoint an estate administrator to ensure efficient handling of the probate proceedings.

In the Czech Republic, you become an heir by virtue of a disposition of property upon death by the testator or by intestate succession.

Revocable unilateral disposition of the testator

Possible effective forms:

Handwritten and personally signed private document

Deed drawn up by a notary

Document drawn up electronically by the testator, signed in their own hand and declared before two witnesses that this is their last will and testament

Special case in the case of a private deed if the testator is not capable of writing the will themself: Presence of 3 witnesses, the testator must be informed of the content and declare that it corresponds to his last will and testament

All of the testator's property can be disposed of in the will.

The will can contain various other provisions, including

Appointment of a legacy

Disinheritance

Conditions and instructions for the heirs (e.g. type of burial)

Determination of substitute heirs

Determination of prior heirs and subsequent heirs.

A private will can also be deposited with a notary; in this case, it is entered and kept in the register of wills, just like notarial wills.

If there are several competing wills, the most recent will takes precedence!

A contract concluded by the testator with a view to designating one or more heirs.

The contract can be concluded with an heir or a third party.

Mandatory form: notarial deed!

Inheritance contract takes precedence over a will!

The inheritance contract can only be used to dispose of ¾ of the estate value.

Used if there is no will or contract of inheritance.

The statutory succession distinguishes between six inheritance orders.

Acceptance of inheritance by an heir of the previous order excludes the claim to inheritance of the subsequent order; the starting point is the 1st order.

The orders are as follows:

The deceased's children and spouse shall each inherit an equal share. If one of the children does not inherit, their children shall acquire their share of the estate in equal shares; the same applies to more distant descendants of the same ancestor.

The spouse, the parents of the deceased, and cohabitants (> 1 year) who maintained the joint household or were dependent on the deceased for support. The heirs of the second order inherit in equal shares, but the spouse always inherits at least half of the estate.

The deceased's siblings and cohabitants (> 1 year) who maintained the joint household or were dependent on the deceased's support. If none of the deceased's siblings inherit, their share of the inheritance passes to their descendants.

The grandparents of the deceased.

The great-grandparents of the testator's parents.

The children of the deceased's siblings and the children of the deceased's grandparents each inherit an equal share. If one of the children of the deceased's grandparents does not inherit, their children inherit.

Even if you were not named as an heir in the will, you may still be entitled to a portion of the estate. This applies in particular to those entitled to a compulsory portion, legatees, spouses and creditors of the deceased.

Persons entitled to a compulsory portion

Children of the testator and their descendants.

Adult entitled to a compulsory portion - entitled to ¼ of his or her statutory share of the inheritance.

Minor entitled to a compulsory portion - claim to ¾ of his or her statutory share of the inheritance.

The claim is asserted against the heir.

Legatee

As determined by the testator in his disposition of property upon death.

The object of a legacy can be individual items, a sum of money, or a claim.

The claim for surrender of the legacy is asserted against the heir.

Spouse (community of property)

If there was a community of property between the deceased and the spouse, this is first divided accordingly and the surviving spouse's share is transferred to the surviving spouse.

Only then is the estate determined and divided between the heirs accordingly.

Creditor

The rights of the deceased's creditors are taken into account in the inheritance proceedings.

The debts of the deceased are included in the estate.

The debts of the deceased are transferred to the heirs.

Ineligibility to inherit occurs by law without any legal action on the part of the testator being required. It is an objective condition in which the heir is excluded from the right of inheritance on legally defined grounds.

Main reasons for ineligibility for inheritance

Committing an intentional criminal offense against the testator, his or her ancestors, descendants or spouse.

Reprehensible act against the last will of the testator

Domestic violence

Withdrawal of parental custody

Disinheritance, on the other hand, is an active legal act on the part of the testator by which he excludes a person entitled to a compulsory portion from his claim to a compulsory portion.

Characteristics of disinheritance

Formal requirements - The declaration of disinheritance requires the same form as a will.

Active decision of the testator - It must be explicit or implied (by not including it in the will if there is a reason for disinheritance).

Possibility of amendment or revocation - The testator can amend or revoke the disinheritance at any time in the form provided for in a will.

The testator can disinherit a person entitled to a compulsory portion if this person:

denied him the help he needed in his time of need,

does not show a sincere interest in the testator, as would be expected of a close relative,

has been convicted of an offense committed under circumstances indicating a reprehensible disposition, or

leads a permanently dissolute life.

Are you unsure whether you should accept the inheritance? Are you worried about the estate being overindebted? Are you afraid of being liable for debts with your own assets? Then you should know this:

+

In the course of the probate proceedings, an estate balance sheet is generally drawn up by the competent notary before the inheritance is accepted.

As an heir, you can get an overview of whether the estate is over-indebted and whether you should accept or reject the inheritance.

To avoid hidden debts, it is advisable to accept the inheritance subject to an inventory.

This reservation means that you as the heir are only liable for the debts of the deceased to the extent of the value of your own share of the inheritance.

-

If you accept the inheritance without reserving the inventory, you are fully liable for the deceased's debts.

If you as the heir discover that the inheritance is overindebted, you are generally entitled to waive the inheritance!

Caution: Acceptance and waiver of inheritance are irrevocable!

Unwanted dispositions of the estate during the probate proceedings are prevented by a rapid inventory and, if necessary, a freeze on dispositions.

Inventory of the estate

The scope of the estate (assets and liabilities) is determined.

Is generally carried out by the notary in all probate proceedings.

In simpler proceedings, the inventory can be replaced by a declaration by the heirs.

Basis for the extent of the liability of the heir who has accepted the inheritance with the reservation of inventory.

Determined retroactively to the date of death of the deceased.

Helpful for determining dispositions of the estate after the death of the testator.

Restriction on disposal of the estate

Can be ordered over all or part of the estate.

Ordered by the responsible notary.

Dispositions of the estate by unauthorized persons are prohibited.

The freeze is ordered in the following cases:

Existence of an heir who does not have full legal capacity (e.g. a minor);

Existence of an heir with unknown domicile;

Risk of an over-indebted estate;

A creditor has applied for segregation of the estate;

Other important reason for special caution.

Remuneration of the notary

The notary's fee for handling the probate proceedings is based on a percentage that depends on the value of the estate.

Expert fees

In order to determine the value of the estate (in particular real estate, motor vehicles), it is necessary to determine the value of the estate on the date of the deceased's death by means of an expert opinion.

Remuneration of the estate administrator

The amount of the estate administrator's remuneration depends above all on the type of appointment (contractual by the testator/heirs or by the court) and the scope of their services.

Legal fees

The amount of the legal fees depends on the scope of the legal advice.

Tax burden

The tax burden depends on the place where the heirs are resident for tax purposes. There is no inheritance tax in the Czech Republic.

Czech inheritance law (from §§1475ff)

The Regulation on the European Certificate of Succession

Website of the Czech Chamber of Notaries

European e-Justice Portal on Czech Inheritance Law

§2 Inheritance Tax Act

Who can support me?

Inheritance proceedings abroad can be a particular burden - whether due to language barriers or physical distance. We understand your situation and are at your side with our experience, empathy and legal expertise.

Giese & Partner has been one of the leading international law firms in the Czech Republic for more than 20 years. We have extensive experience with cross-border inheritance proceedings. Our teams of German and Czech lawyers will explain the legal situation in both countries to you in an understandable way and will enforce your rights in the best possible way before notaries and courts - from local district courts to European courts.

We provide you with comprehensive and personal support in the settlement and administration of international inheritances and estates within and outside the EU.

Our experts on inheritance law